Start your dream project?

We have a TEAM to get you there.Generative AI in Banking has been redefining the stories of business. Businesses have unique demands and so banks need a solution to translate better services, personalized approach, cost reducing strategies, zero frauds and much more. To stay ahead in competition bankings is adapting to a newer approach of AI.

According to Wikipedia, there are more than 4000 banks in the United States, and all of them are willing to switch to automation. Want to know the reason behind this change? It’s Ultimate customer satisfaction.

Statista has shared data that mentions that Generative AI in the banking market will reach $66 billion by the end of 2024. The market can also rise to $1.3 trillion by 2032, according to the specific usage of the technology. This data is based on the United States market, where people value sophisticated banking procedures.

This information makes it clear that enterprises in the banking sector must focus on the correct implementation of technology to generate better ROI and provide the best customer service.

We hope that the video has provided you with factual information regarding the utilization of Generative AI in the banking sector. The blog will further provide detailed information for banking enterprises that want to integrate Generative AI into their banking operations.

Brief Overview of Artificial Intelligence in Banking

Top banking firms have shared that operability and scalability are the two main concerns. This is because the market is frequently changing based on consumer needs. They are willing to receive quick responses from the banking staff. Sometimes, it is challenging to fulfill the consumer’s demands, which is why the implementation of Generative AI in Banking is required.

The technology effectively enhances security and personalizes the banking experience for the customers. The technological aspect of the banking processes has engaged the banking personnel so well that they are aligned with fruitful business operations. Another feature for which most bankers appreciate Generative AI is the data with which market trends and supreme investment ways are suggested.

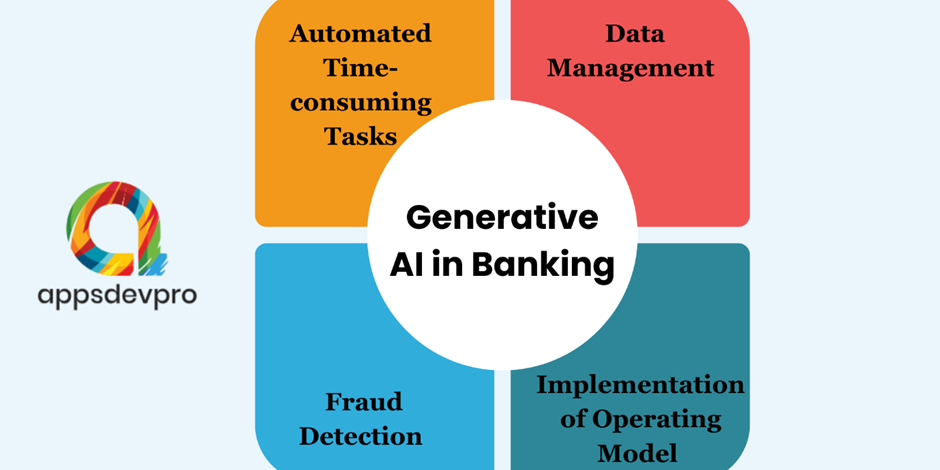

How Generative AI Will Affect Banking Operations?

Innovation in the technical aspects of banking has led to various opportunities that direct it towards success. In this section, we will share how banking firms benefit from artificial intelligence.

Reduction in Time-consuming Tasks

The crucial tasks, such as data entry and payment processing, consume sufficient time for the staff members. With generative AI, the data has to simply be entered in a single time, and then the banking processes are initiated automatically. This calls for a future need because the banking personnel want to sort the processes at a faster pace. Generative AI in Banking is, moreover, a decent way to manage tasks.

Data Management & Fraud Detection

In simple terms, managing data means that the banking staff, as well as the customers, can extract the information conveniently. The cybersecurity aspects are detected automatically. Customer risk profiles are generated, and the probability of financial loss is analyzed for the sake of managing business risks. Transactional data, including history and ongoing financial transactions, is analyzed to determine vulnerabilities in order to detect fraud.

Implementation of the Operating Model

The representation of how a particular business operates is with an operating model. Gen AI helps companies to provide better strategies according to the existing business model. The personnel can later make relevant modifications. Basically, changes are done in roles & responsibilities, performance management, customer service, and work culture. Two crucial factors that are included in this model are:

Setting Specific Standards for All the Employees

Data practices and risk frameworks are integrated with the regular working process of a bank. There are architecture choices for various bank departments regarding cloud storage. Access control and authentication can be selected according to the particular business operations.

Gen AI for Enterprise Strategic Planning

Gen AI use cases are integrated according to the business goals to support the profits of a particular banking organization. Generative AI in Banking helps implement efficient resource allocation to simplify business operations.

Continuous Modifications for Business Success

Generative AI in Banking is a cost-effective solution for enterprises as they can innovate their work ethics. The staff members tend to follow the regulations, avoiding any legal matters. The details are already listed in the database on a shared platform that can be accessed by authorized users.

The digital revolution has made it convenient for banking employees to open accounts faster using mobile applications, and they can even check customers’ transactions, loan applications, and investments. When all the banking operations are appropriately managed, the short and long-term business goals are met efficiently.

The supreme financial institutions of Europe and the United States have profited with approximately $26 Trillion in assets after the implementation of Gen AI. The data suggests that there is a future for Generative AI in banking, and the above points also mention that banking owners must make efficient use of the technology.

Want to strengthen the core of the banking web applications? Hire Python Developer who can work on server-side applications promptly.

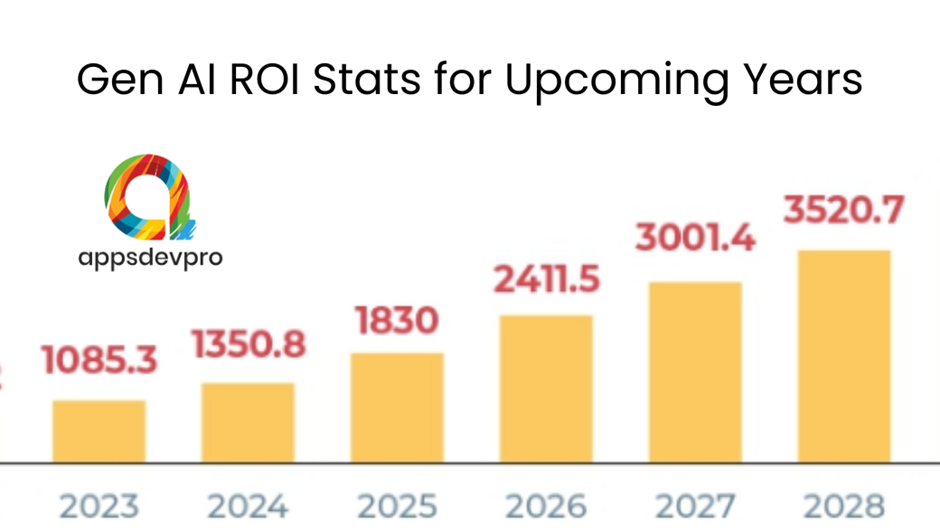

The future of generative artificial intelligence is all about generating better revenue. The image below shares the graph in which ROI is shared.

As you can see, in the present year, ROI is 1350.8 in USD, and by 2028, it is expected to reach USD 3520.7.

How Automated Customer Interactions Are Made Using Chatbots And Virtual Assistants?

Generative AI is simply not implemented to provide the best content but also to serve the customers. This is done according to the availability of the banking personnel. It is vital to meet consumer’s expectations to maintain the stability of a business. Here are some of the ways how Gen AI has improved overall business operations:

Understanding the Customer Needs

AI tools analyze consumer requirements by reading the previous conversations with the customers. For example, a chatbot works on an e-commerce website to understand the potential requirements of customers. This has helped the sales personnel conduct thorough research on clients’ needs.

Step Ahead for Lead Generation

Around 67% of businesses have experienced chatbots as helpful in generating leads. This is a question for many enterprise owners as they want to ensure that their revenue is applicable to the favorable segment only.

Improve Marketing Communication

Relationship managers have to ensure that they are proceeding in the right direction when dealing with potential customers. The financial market usually experiences a shift from improved business.

It is true that most customers are not completely satisfied with the chatbot service, but in the near future, AI will influence the whole market.

Why Do Top Enterprises Use Chatbots?

To streamline customer engagement, enterprises make efficient use of chatbots. The 24×7 customer service provider has to make sure that the services are provided to the consumers on top priority.

Conversational Commands are Easy to Engage with Customers

The traveling application has integrated Conversational AI so that quick resolution to the queries is provided. The customers will not be kept waiting. Unlike the banking sector, it has used conversational AI to give empathetic responses.

Banking Information Availability at any Time

Nowadays, consumers do not have to ask which personnel to know a particular information. They can directly provide the query on Conversational AI, such as a chatbot, to know the details. Also, the information is accessible on a shared basis, which provides security.

Banks have Experienced Increased Customer Loyalty.

You know that your consumers will be loyal to you only when you provide relevant services. If they lack one of the other services, then it is a problem for the bank’s market value. The banks that are implementing generative artificial intelligence are gaining 3.2 times better customer insights than those companies that are not. Gen AI is helpful in sharing particular customer queries such as balance inquiries, bank account opening inquiries, loan applications, etcetera.

We hope you have received proper reasons why the top companies are selecting chatbots to converse with the customers. There is no doubt about the skills of the banking staff. It is just that virtual assistants act as a bridge between customer queries and a service provider.

What are the Use Cases of Generative AI in the Banking Industry in 2024?

There is no confusion about the implementation of Gen AI in the banking sector because of numerous profits.

Use Case 1. Fast Customer Support

Millions of interactions with customers and other stakeholders have become convenient with virtual assistants. The chatbots converse with the banking user as a human that sophisticates the banking procedure. The user has to simply write a query such as “I need to check my account balance, please share.” The chatbot might ask the user to provide bank account details for this purpose.

Use Case 2. Financial Advice by AI-driven Data

Consumer behaviors are predefined with the data analytics feature of generative AI. This insightful data is adequate to provide a personalized customer experience and also suggest client-specific banking actions to understand client’s preferences. This financial advice is practical for the clients and banks to generate better revenue. For example, if a customer is investing in mutual funds, fixed deposits, or recurring deposits, it will benefit the bank.

Use Case 3. Decision-making for the Banking Firms

Current procedures for making an effective decision are smooth, but these can be better with generative artificial intelligence. Here’s how. AI tools provide economic indicators according to competitor analysis, market data according to the changing financial trends, and suggest investment opportunities. There are basically the key indicators that help banks to minimize losses.

Use Case 4. Real-time Monitoring for Regulatory Compliance

All the banks have to work according to the changes provided by the Government or other regulatory authorities. Gen AI checks newer compliance risks, generates banking reports on time, and interprets customer requests. For example, generative artificial intelligence provides data for the latest US regulations that have to be followed by all the banks.

Use Case 5. Automated Regular Tasks

Reduced human input for banks has helped officials solve most problems. There are fewer errors in the reports, and processes are accomplished with a relevant speed. The banking officers can now access the structured data initiated with the AI tools. Earlier, the officers had to check each transaction to extract the profit and loss statement, but now the details are automatically generated. The users have to simply share a query as input into the AI tool.

If you want to accelerate your business operations and move ahead of your competitors, then, indeed, implement AI technology. The technical aspects will help in overall business growth, considering core competencies.

Ready to solve your banking challenges with AI Hire AI Developers to create the perfect tool for your business.

Conclusion

We hope that this blog has shared the required knowledge with you and has shared an answer with you about implementing Generative AI in banking operations or not. Technology evolves businesses by streamlining processes. The banks will receive a competitive edge when their customers are satisfied. Thus, Gen AI assures 24/7 customer support with the help of chatbots.

In summary, enterprises must develop mobile and web applications to bring a strategic approach to attracting potential clients. These applications will provide better data insights, enhance customer experience, and reduce cyber vulnerabilities in the banking network.

Why Select AppsDevPro for Implementing Generative AI in Banking?

Experts of AppsDevPro have the desired skills and knowledge and can build helpful software applications for your bank. Enterprises have to be concise with their requirements, and accordingly, they can Hire Developers from AppsDevPro. We have been working for more than 21 years and have the experience to turn an idea into reality. Our professionals understand that banking is not a one-day job but an ongoing process that requires dedication. Contact us today to be sure you receive quality service. You can also contact us by mail or phone to receive a proper consultation for building a software application if you are in doubt regarding technicality.

FAQs

There must be some factors remaining while reading the blog. Hopefully, this section will be able to target those.

What are the Challenges that need to be overcome while Implementing Generative AI in Banking?

Tech Challenges is the top one because the banking staff can intelligently solve the banking concerns but are not technically sound. They have to be provided with training by either an IT staff member or an IT person to solve the issues as soon as possible. The second most important is the integration with the older system. In this situation, the developers have to be provided with the system requirements and existing system configuration so that they can build a robust software application.

How can personalized financial advice be provided to a banking customer with Gen AI?

Generative artificial intelligence provides data insights according to customers’ transactional history. This process predicts the financial requirements of a client, and financial advice is shared with them. The financial solutions include savings plan ideas and investment strategies for banking firms. Also, pricing for the banking products is suggested according to the market trends. The banking professionals can later contact potential consumers through the cold calling process or via email marketing.

How Customer Service Is Improved with Generative AI in Banking?

Revolutionization in the banking sector is initiated due to automated business operations and 24/7 customer support. Enterprises can Hire PHP Developers who can build scalable chatbots with all considerable functionalities. The virtual assistants will provide answers to specific customer queries. If the issue has to be solved practically, then a banking professional is assigned to help the customer. Generative AI can draft customized emails that are subject to the pain areas of the customers and their solutions accordingly. This process is helpful in generating quality leads for banks.

Can Gen AI Solve Business Complexity?

The main issue in the banking sector is managing data promptly. However, it is the core feature of generative artificial intelligence to provide data insights and data relevance so that customer requirements can be identified. Also, the data is shared on a cloud platform that can be accessed by any banking personnel at any time and from anywhere. Therefore, the banking process complexities are immediately resolved, leveraging banks to provide the best service.

Is There a Future of Generative AI in Banking?

Yes, there is a future for generative AI in banking because it automates regular business processes such as account handling and quick response to customer queries. There are reduced errors in the tax returns, loan applications, and transactional enquires that sophisticate the bank’s procedures. Since the operations are automated and can be completed from a mobile application, it has proved to be a time-saving activity for the staff members. They can engage in creating better business strategies to gain customer loyalty and solve their concerns.

You can also check our other services:

Hire Xamarin App Developer in India, Hire iPhone App Developers in India, Hire Android App Developers in India, Hire Flutter App Developer in India, Hire React Native Developers in India, Hire Kotlin Developer in India, Hire PHP Developer in India, Hire Laravel Developer in India, Hire Nodejs Developer in India, Hire Microsoft Developer in India, Hire ASP.NET Developer in India, Hire Angular.js Developer in India, Hire React.js Developer in India, Hire E-commerce Developer in India, Hire Magento Developer in India, Hire WordPress Developer, Hire AI Developers in India, Hire Java Developers in India, Hire Python Developers in India, Hire Javascript Developer in India, Hire AR/VR Developers in India, Hire Blockchain Developers in India