Start your dream project?

We have a TEAM to get you there.Generative AI in Financial Services is effective in analyzing market risks and providing personalized customer experience. Do you know that there are around 1400 Fintech startups that have already started to utilize generative AI in their services?

Their main purpose is to provide the best services to the customers. Generative AI in Financial Services is revolutionizing the financial services landscape by offering innovative avenues and improving service delivery to enhance customer experience.

They can suggest newer and more practical solutions to them. Companies need to consider various factors when working with different clients to provide optimal solutions. Generative AI can help solve many problems, improving efficiency and productivity.

The businesses can get an idea for Generative AI in Financial Services from the video shared below. Yahoo Finance has clearly mentioned the statistics about the implementation of technology.

The video has given an idea to the financial institutions that they can automate the business process. It helps in fraud detection and enhances the speed of work. Read the entire blog to know more about the technology and its implementation.

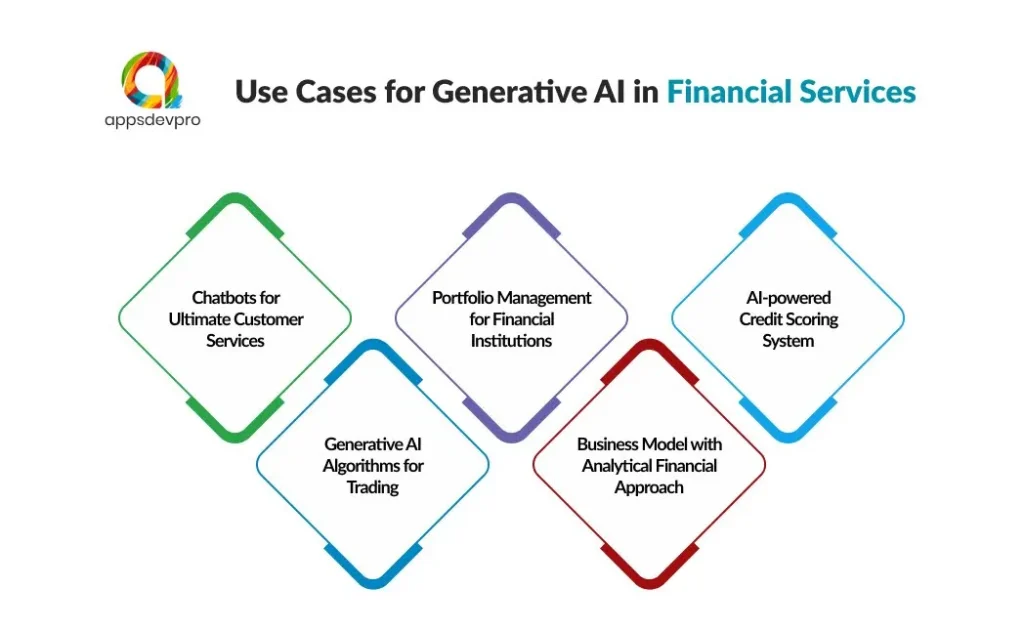

5 Use Cases for Generative AI in Financial Services

The ways in which unstructured data is converted to useful insights that provide information for investment opportunities, market trends, and portfolio performance. The fintech companies wait for such kind of opportunities in which the data is provided to consult personnel in a sophisticated manner.

AI and machine learning algorithms allow companies to gather information considering the investments of customers. The financial products are then shared with the potential buyers considering their buying behavior and buyer persona.

Considering this aspect, we have shared various use cases for reference below:

Use Case 1. Chatbots for Ultimate Customer Services

Virtual Assistants serve as a helping hand for companies. They help customers 24/7 assisting in customer account balance and providing financial advice. Financial chatbots can handle multiple requests from different channels while assisting with a quality and data-driven solution.

Use Case 2. Generative AI Algorithms for Trading

Before the introduction of artificial intelligence, processes such as trading and investments were the toughest things to do. Harnessing the power of Algorithms, Predictive forecasts, and transformative technology stimulates various market conditions and helps predict potential outcomes that provide invaluable insights for making informed investment decisions.

With Generative AI and algorithmic tradition, investment firms and hedge funds execute trades, analyze the market condition, and capitalize on lucrative opportunities for investing.

Use Case 3. Portfolio Management for Financial Institutions

The financial institutions have to take care of the aspect of wealth management. But how they will be able to do it? Simple, with Portfolio Management via General AI in Financial Services. Generative AI models can analyze a vast array of financial data, economic indicators, market trends, and individual client profiles. Financial Accounting Software implementation will be the best for finance companies who are willing to manage the portfolios. Contact our professionals today to receive the consultation.

Using this data, AI can generate predictive models that recommend optimal asset allocations and investment strategies. Ultimately, service scalability is increased with the technology.

Use Case 4. AI-powered Credit Scoring System

What do you understand about this use case? Being a financial services company, an AI-powered credit scoring system means that the ROC and F1 scores are analyzed. This improves accuracy, increases customer retention, and easy to deploy financial products. The process helps businesses to make effective business strategies and decisions to manage the ever-changing consumer demands.

Use Case 5. The Transformation from a Manual to an Analytical Financial Approach

Banking, financial services, and insurance are all a part of the fintech industry that has to be managed properly. This involves a lot of data transfer regularly. Integrating document management in the process requires minimal input to convert the process to automation. Additionally, efficient workflows are designed with Generative AI ensuring the business’s success.

The business owners might be wondering about the aspect of “How”. Well, success cannot be achieved in a day. However, Natural language processing, Robotic Process Automation, and ML algorithms process the data into effective format. Outsourcing developers from AppsDevPro will help increase business productivity. Let’s explore more real examples of how the industry-dominant players are integrating Generative AI in Financial Services.

Struggling with outdated business strategies? Hire Android App Developer to get scalable app solutions to transform the entire operability.

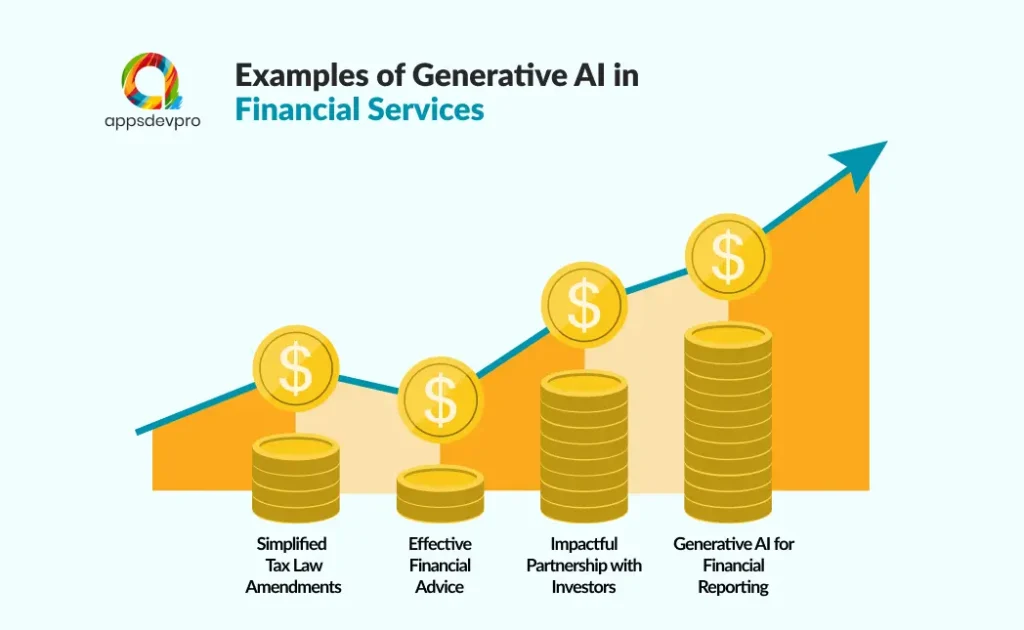

5 Real Examples of Generative AI in Financial Services

In the previous section, we have shared the different use cases that can be implemented by the financial service providers. To simplify the usage of the Generative AI in Financial Services, we are sharing the real examples here.

Example 1. Simplified Tax Law Amendments

Taxation laws, rules, and regulations should be adhered to by the financial institutions to stay legally compliant in the market. There should be no scope left for the authorities to claim for a particular tax. Generative AI in Financial Services helps in adhering to the latest updates in existing data and complying with policies.

Example 2. Practical Financial Advice

Investments should not be biased and generic. With Generative AI underscoring their income, financial, goal, age, type of job, and other financial goals, AI can deliver highly personalized strategies that maximize financial health and growth.

Example 3. Financial Marketing for the Businesses

Why does marketing have to be performed despite market stability? Owners must check out the list of competitors in today’s time. To keep the head without any financial loss, marketing is important. Generative AI in Financial Services provides unique content in terms of videos and images that can be utilized to create the best social media posts, blogs, and website content to attract potential customers.

Example 4. Say Hi to Mergers and Acquisitions

Searching for effective ways of business expansion? If yes, then implement Generative AI to address investment bankers and M&A analysts to merge and invest in your business. This will help you to bring more potential to stay ahead of the competitors. Wondering HOW? Better quality potential targets are identified with the help of technology that too at a faster pace.

Another way is the competitor analysis is done by predictive analytics which is useful to build and implement effective competitive strategies.

Example 5. Generative AI for Financial Reporting

Do you know about the 2008 financial crisis? The market was shredded with a large amount of data. After that, regulators imposed a regulation on the financial institutions to provide a valid report for every financial year. It is simple, you have to add the data to the system and Generative AI will provide an instant report. Do a proofread for that to ensure that the included data insights of your business are accurate.

Kindly note that there are risks in the industry even if you implement a technology or not. To stay ahead in technology and future-proof investment you need the help of experts. Hire Developers to tailor your specific needs and build effective mobile or web applications as per your specific business requirements.

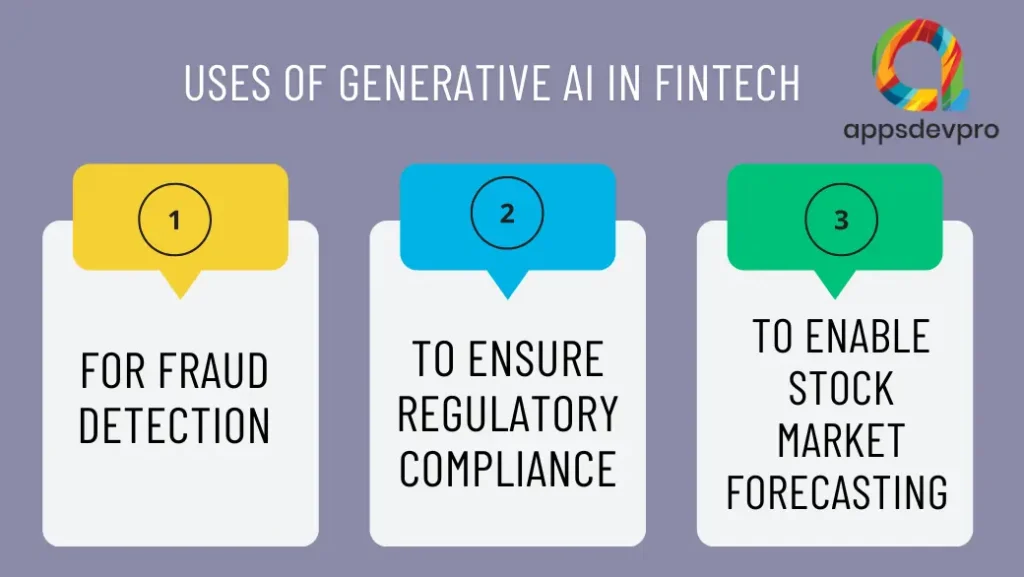

3 Ways in which Generative AI insights are used for Fintech in 2024

More than 40% of consumers are likely to select online services rather than manual. Because it saves their time and increases productivity. Understanding AI is complicated. The emerging trends are hence helpful for companies to provide superior customer service. $25 Billion is the predicted Generative AI market reach in 2033. The reason to share this data here is that most of the businesses have just entered the industry and most are seeking expansion.

1. For Fraud Detection

Financial companies are all the time in the midst of securing their information from intruders. Especially in a country such as the United States where most financial work happens, data is usually at risk.

2. Focusing on Regulatory Compliance

Generative AI detects data by the norms and policies that businesses must adhere to gain credibility in the marketplace. Any changes in policies are communicated to stakeholders, who can then make the necessary adjustments to their business processes.

3. Stock Market Forecasting

AI is well-equipped to conduct thorough, ongoing pattern analyses on market data to identify trends. It can then compare these trends to past behaviors to improve forecasting results. It is possible that AI could bring a new level of accuracy and speed to market forecasting in the coming years.

The above discussion indicates that AI insights will be utilized for Fintech in 2024. Companies should consider hiring AI developers from AppsDevPro, who can build effective web applications.

Revolutionize your operations with AI-driven data for smarter financial strategies. Hire Web Developer today

What are the Challenges of the Fintech Sector?

The blog has detailed the critical aspects of Gen AI in financial services but enterprises must know why they have to implement this technology. For this, we have shared the existing challenges in the financial sector below:

1. Data Protection Issues

In today’s environment of increasing cyber threats and malicious activities, safeguarding data is of utmost importance, especially in the finance sector. It’s concerning that 64% of customers choose not to engage with businesses due to data privacy worries.

Given that the finance sector deals with extensive amounts of data, it is particularly vulnerable to cyber-attacks and data breaches. It is essential to find a solution to this problem in order to earn the trust of potential customers.

2. Payment Concerns

The cross-border payment issues are increasing day by day which is why the fintech companies are searching for a solution. When an investor has to receive the funds or the companies have to make an online transfer then payment issues delay the entire transaction.

3. Frequent Changing Business Models

Every banking firm has a specific business model that the staff members follow. But it depends on the growth whether that model can work effectively or not. Businesses have to make relevant changes in their business models according to various aspects such as market trends, cost, and market stability.

4. Outdated Mobile and Web applications

Outdated applications and manual processes do not allow a large number of users to access the data at the same time With AI tools and techniques, cloud infrastructure, and IoT; several users such as customers and staff members can connect on a network to work efficiently. Traditional apps are not useful for solving customer queries such as being available 24/7. Newer software applications have chatbots and virtual assistants that provide better connectivity.

The market size of lending, insurance, and investments is gradually increasing, leading to increased competition. Startups or mid-sized companies have to make continuous efforts to maintain market stability for which the implementation of Generative AI is a prompt solution. Continue reading to know how design principles are beneficial to resolving the financial queries of businesses.

Also Read: 11 Use Cases of Data Science in Finance & Banking Sector in 2024

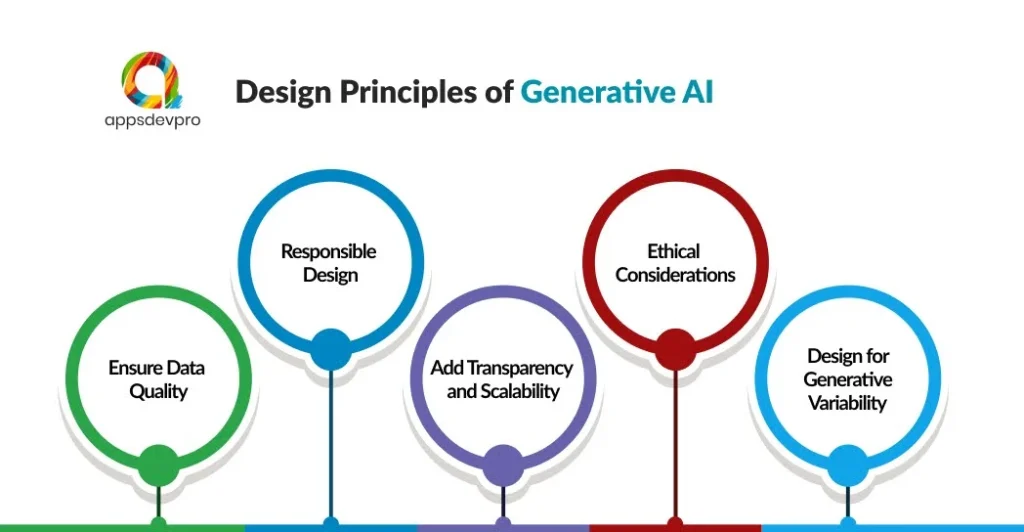

What are the Design Principles of Generative AI?

Generative AI has the capability to learn from extensive datasets and generate responses as per the input of queries. It magnifies and analyzes data, identifies past trends, and drives toward better decisions.

In the finance industry, it can assist in redefining traditional approaches and drive realistic, informative, and data-driven decisions that optimize strategies, enable sophisticated risk simulation, and detect fraud.

When building a software application (web or mobile) with Generative AI in Financial Services, the developers must ensure that design principles are considered. This is because enterprises have to ensure that an enhanced user experience is provided.

Below is the list of fewer principles:

Design Principle 1. Ensure Data Quality

The thumb rule of designing the generative AI for financial services is to consider the completeness and responsiveness of the data. The AI developers acknowledge the requirements and thereby submit the code for testing. The benefit of data quality is that there are fewer errors while performing any kind of financial task.

Design Principle 2. Responsible Design

What is design responsibility and how does it affect my business? If the software application is not developed with a human-centered approach then the outcomes will not be accurate. Project managers must specify the software product requirements prior to the development process. Developers have to make sure that the design meets regulatory compliance and does not affect ethical/legal issues. These can be incorporated by understanding the Government-affiliated rules and regulations.

They can Hire Full Stack Developers from AppsDevPro who can build the responsible design for an AI product. The personnel must have sufficient experience and knowledge to create a design that matches the client’s intent.

Design Principle 3. Transparency and Scalability

While building a software application for your business make sure to include Transparency and Scalability features. What does this mean? It means that the application is easy to access, can manage modifications, and is effective for businesses or customers.

Design Principle 4. Ethical Considerations

The software has to be built according to legal requirements. There should not be any specific concerns for the applications that comprise any kind of trust issues. Most financial institutions have to compromise funds due to a lack of legal documents.

Design Principle 5. Design for Generative Variability

The developers must include various outputs and variations according to frequently changing market trends. However, iterations have to be made even after the deployment of the software product. Moreover, the design must comprise the essential design features.

USD 7984.6 Million is the expected reach of the Generative Artificial Intelligence in Financial Services by 2032. Bard and ChatGPT are popular generative AI tools that have simplified business processes to a great extent. Why? The users find it convenient to search for specific content.

Why the fintech companies are deploying it? Because the seamless integration of technology in the cloud-based environment has provided accessibility to a large number of users. Besides this, complex tasks can be done efficiently and fraud detection and portfolio optimization are some more benefits.

Conclusion

The fintech industry must acknowledge that there are challenges in manual work that can only be resolved with automated services. The transmutation of customer data into meaningful insights is beneficial for companies in understanding specific areas and providing effective solutions. In summary, this detailed blog concludes that Generative AI in Financial Services is a prominent solution for addressing specific business queries.

The successful implementation of the technology can be done by integrating a software system with the existing business processes. To do this, companies can hire developers who can build secure web and mobile applications. Contact our experts today!

Why Fintech Companies Must Choose AppsDevPro to Implement Generative AI?

Fintech Companies have complex requirements. Understanding trends, and technologies and undertaking multiple parameters, there is a need for robust and inclusive custom solutions. Our AI developers understand the intricacies, requirements, and end goals.

Combining our expertise, skills, and advanced technologies, we build solutions that meet the needs of clients and end-users. If you want to get a prime solution for your Fintech business it’s the right time to hit the market and Contact Us!

Frequently Asked Questions (FAQs)

Fintech companies must read the essential information for Generative AI in Financial Services from this blog as a reference. If you still have some questions, browse this section.

How Does Generative AI Affect Financial Services?

Gen AI is a revolution for banks and financial institutions. Because:

- It predicts frauds.

- Analytics help in data-driven insights to improve business performance.

- Automates financial services.

- Speed up code development and build regulatory reports.

- Fast resolution to customer queries with Chatbots.

To sum up, Generative AI will transform business operations in a manner that the customers will be satisfied and revenue will also be increased.

What are the Challenges of Artificial Intelligence in Financial Services?

There can be faults in the technical product which is why there is a challenge to purely implement artificial intelligence for financial services. The technology is expensive and also leads to financial data quality issues. But the supreme thing is that it refines the business operations and improves efficiency.

How to Use AI in Financial Planning and Analysis?

The financial situation of a business has to be analyzed timely to overcome market challenges. Manual tasks however increase inefficiencies, thus, AI in financial planning helps in risk management, automates tasks to enhance operability, and reduces extra costs required to maintain business stability.

Hire AI Developers from AppsDevPro who can build applications that can analyze a large amount of data and generate useful insights. This piece of information can be used to mitigate financial risks and understand customer requirements in the best possible way.

How will Generative AI Affect Banking?

Banking is an industry in which there is no end to customer queries but also a great opportunity to withstand in the market. Moreover, Generative AI in Banking boosts customer response via virtual assistants, helps in detecting fraud on the app and website, and predicts market trends for corporate banking.

How Generative AI Could Change Your Business?

The major requirements of financial service providers are to get relief from fraud and to meet client expectations. Both of these aspects are conveniently achieved with the implementation of Generative AI. The technology approaches pain areas of business such as R&D, Sales, Marketing, and Operations that minimize traditional working and promote automation.

Read More:

You can also check our other services:

Hire Xamarin App Developer in India, Hire iPhone App Developers in India, Hire Android App Developers in India, Hire Flutter App Developer in India, Hire React Native Developers in India, Hire Kotlin Developer in India, Hire PHP Developer in India, Hire Laravel Developer in India, Hire Nodejs Developer in India, Hire Microsoft Developer in India, Hire ASP.NET Developer in India, Hire Angular.js Developer in India, Hire React.js Developer in India, Hire E-commerce Developer in India, Hire Magento Developer in India, Hire WordPress Developer, Hire AI Developers in India, Hire Java Developers in India, Hire Python Developers in India, Hire Javascript Developer in India, Hire AR/VR Developers in India, Hire Blockchain Developers in India