Start your dream project?

We have a TEAM to get you there.Hotel and restaurant mobile payments are turning into a new normal. Wondering how?

The increasing expansion of digitization all across the globe has added more convenience to people’s hands. And making mobile payments is one of the most common practices among users.

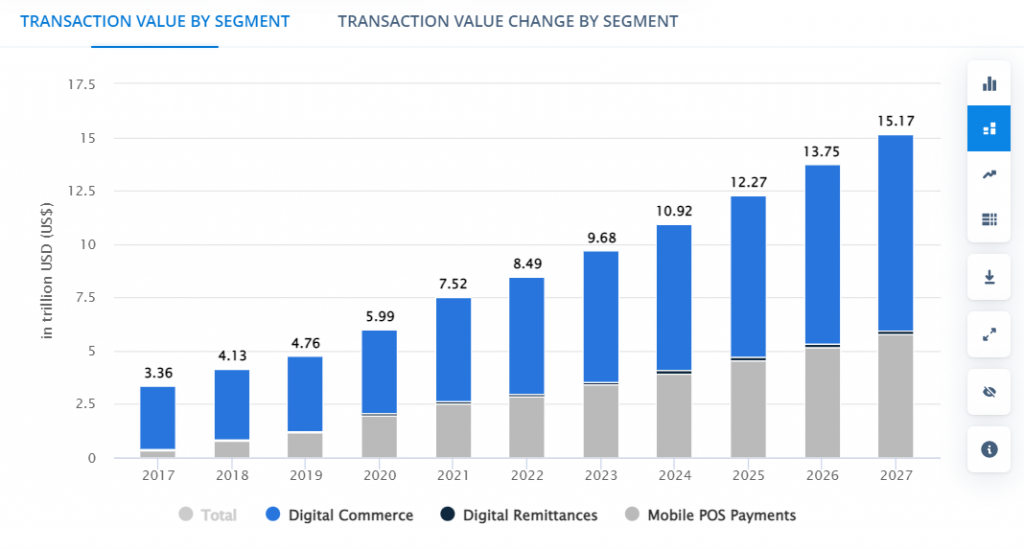

According to Statista, the total transaction value in the digital payment segment is projected to reach $9.68 trillion in 2023.

The total transaction value is expected to show an annual growth rate of 11.88% resulting in a projected total amount of US $15.17 Trillion by 2027.

While many industries are adopting this trend of making online payments but restaurants and hospitality industries are those that are majorly meant for comfort and convenience. And this trend of hotel and restaurant mobile payment has started with industry giants such as Hilton and Marriott, Wendy’s and Starbucks.

By hiring Indian mobile app developers, anyone can easily get started. But to begin with this facility, you need to plan a smart solution to offer a secure and seamless payment platform.

The emergence of mobile payments in hotels and restaurants has revolutionized how customers pay for their purchases. In recent years, mobile payments have become increasingly popular in the hospitality industry, offering customers a convenient and secure way to pay for their meals and overnight stays.

Image Source: statista

As customers become more comfortable with using their phones or other devices to pay for goods and services, mobile payments have become the new normal for hotels and restaurants.

Before you get straight into the process of hiring a mobile app developer in India to create a mobile payment app you need to understand a few things.

In this blog post, we’ll take a closer look at why mobile payments are quickly becoming the industry standard in hotels and restaurants.

Table of Content

- Why have Cash Payments In Hotel and Restaurant Industry Becomes Out Of Fashion?

- Why Hotel and Restaurant Mobile Payments Become New Normal?

- How Can You Offer Mobile Payment Option At Your Restaurant and Hotel?

- Conclusion

- FAQs

Let’s get into the details of these points…

Why have Cash Payments In Hotel and Restaurant Industry Becomes Out Of Fashion?

With customers demanding more convenience and businesses recognizing the advantages of mobile payments, cash payments in the hotel and restaurant industry have become out of fashion.

Whether you are a hotelier or a restaurant owner, you might have come across this question “do you accept mobile payments?”.

This is one of the most commonly asked questions by guests. In case if your answer to this question is NO, then you will surely be far away from the market competition.

However, if your answer is Yes, then your hotel will definitely get a green tick on the guest’s mind.

So this is how hotel and restaurant mobile payments are making a considerable difference among users. This is why hoteliers are hiring software developers in India to get started with the mobile payment application. But what if you are still untouched by the mobile payment options?

If you are still stuck to traditional payment methods, then you will find yourself at a disadvantage compared to those that do.

Offering mobile payments allows businesses to improve customer satisfaction and remain competitive in an increasingly digital world.

For hotels and restaurants, offering mobile payments is becoming an important competitive advantage. Customers expect convenience and efficiency, and those that don’t offer mobile payments will be at a disadvantage.

Hotels and restaurants that offer mobile payments can quickly become a go-to choice for customers who value speed and convenience.

In a nutshell, as the hotel and restaurant industry continues to evolve, mobile payments are sure to remain an integral part of the industry.

Businesses that want to stay competitive must embrace this new technology and learn how to effectively use it to meet the needs of their customers. Mobile payments are no longer just a trend: they are becoming the new normal.

Why Hotel and Restaurant Mobile Payments Become New Normal?

The world is becoming increasingly mobile, and the hospitality industry has been quick to adopt the trend of mobile payments. Hotel and restaurant mobile payments are becoming the new normal, and for good reason.

Before you hire an app developer in India to integrate a mobile payment feature into your system, let’s learn about the reasons why hotel and restaurant mobile payments are catching the attention of businesses.

-

Customers Are Demanding For More Convenience!

With the rise of mobile technology, customers now expect convenience in all aspects of their lives. In the hospitality industry, that means customers want to be able to pay for their meals and accommodations quickly and easily.

Mobile payments allow them to do just that, whether they’re paying with a credit card, a smartphone app, or even their voice.

Customers can quickly pay for their meals or stay without having to wait for a server or desk clerk. With restaurant mobile payment apps, customers can easily keep track of all their transactions in one place and manage their accounts.

In addition, mobile payments offer customers the added convenience of not having to carry cash or worry about leaving cards behind.

By offering mobile payments, businesses can make it easier for their customers to complete transactions, boosting customer satisfaction and loyalty in the process.

-

Mobile Payments Ensures More Secure Experience!

Using mobile payments in hotels and restaurants eliminates the need for cash or credit cards. Restaurant payment apps usually process payments through secure payment gateways that use advanced encryption to ensure the data is protected.

This means customers can make secure transactions without having to worry about their information being exposed or compromised. With mobile payments, customers can be assured their financial information is kept safe and secure.

Also, mobile payments are far less vulnerable to fraud than traditional methods. To ensure a secure payment solution, you can hire Indian mobile app developers that help you add a few layers of authentication, such as PINs or biometrics, which makes it much more difficult for criminals to access customer accounts.

And if any suspicious activity is detected, it’s easier to track down the responsible parties and take appropriate measures.

Overall, using hotel and restaurant mobile payments can offer an added layer of protection for both businesses and customers.

It gives customers the confidence that their financial information is secure, while also providing businesses with peace of mind that their sensitive data is safe.

-

Mobile Payments Are More Efficient For Both Businesses and Customers!

Mobile payments offer a faster, more convenient experience for both businesses and customers alike.

Image Source: lyra.com

Hotel and Restaurant Mobile Payment Benefits…

Let’s understand the major benefits of digital payments for businesses:

- For businesses, mobile payments are much more efficient than traditional methods of payment.

- By hiring Indian mobile app developer, Businesses can quickly and easily accept payments from customers with minimal effort.

- Furthermore, these payments can be processed more quickly and securely than traditional methods, saving businesses time and money.

That’s not all! Hotel and restaurant mobile payment systems are beneficial for customers as well.

- Customers can also benefit from mobile payments as they no longer have to worry about carrying cash or waiting for their cards to process.

- Customers can simply pay with their phones and enjoy a much quicker and more secure checkout experience.

- Additionally, customers can also save money as many mobile payment services offer special discounts or reward points that can be used towards future purchases.

- Seamless payment procedures can ensure satisfaction and excellent experience.

Overall, mobile payments are a great way for businesses to provide an efficient and secure payment experience to their customers.

By offering this type of payment method, businesses can streamline the checkout process while ensuring their customers feel safe and secure when making a purchase.

Mobile payments are becoming the new normal in the hospitality industry, so businesses should seriously consider taking advantage of them to stay ahead of the competition.

How Can You Offer Mobile Payment Option At Your Restaurant and Hotel?

Offering mobile payments at your restaurant and hotel can be a great way to keep up with the times and make transactions more convenient for both you and your customers. Here are some tips for getting started:

Step: 1. Choose the Right Payment Processor

Choose a reliable payment processor that will be able to securely process payments from customers’ phones. You should also look for one that is easy to use and offers features like invoicing and real-time reporting.

Popular providers include Square, Stripe, PayPal, and Apple Pay. Each provider has their own unique features and fees, so it’s important to compare them carefully before making a decision.

Step 2. Integrate Mobile Payments into Your Existing System

Once you’ve chosen a payment processor, it’s time to integrate it into your existing system. This means ensuring that payments are processed quickly and securely without any glitches.

To make this feature work for your hotel or restaurant, make sure you hire an Android app developer in India to create a restaurant payment app. In case you already have a mobile app or website, then experts can help you integrate the multi-payment option into your existing system.

Step 3. Multiple Payment Options

Finally, you should consider enabling mobile payments in your restaurant or hotel. There are several different ways you can do this, including mobile apps, QR codes, and NFC (Near Field Communication) technology.

Mobile apps are particularly useful as they can be used to store payment information securely and make checkout easier for customers.

You can hire a dedicated development team to customize the payment feature in your app. Make sure you ask for less details and keep it secure.

By following these steps, you can ensure that your hotel and restaurant mobile payment is secure and ensure a seamless mobile payment experience for customers. Doing so will help you keep up with the times and make transactions easier for both you and your customers.

Conclusion: How Does AppsDevPro Can Help You With Hotel And Restaurant Mobile Payments?

At AppsDevPro, we understand how important it is for hotels and restaurants to stay up-to-date on the latest mobile payment trends. Our team of experienced developers can help you integrate and manage a secure and efficient mobile payment system.

By hiring mobile app developers in India, you can get expert assistance that enables you to provide a seamless mobile payment experience that customers expect. This will not only increase customer satisfaction and loyalty but also generate more sales and revenues.

At AppsDevPro, we are dedicated to helping you provide the best possible mobile payment experience for your customers. Contact us today to learn more about how we can help you create a secure and efficient mobile payment system.

FAQs

What Should Hoteliers and Restaurant Owners Keep In Mind While Moving To Mobile Payments?

Hoteliers and restaurant owners should consider the following when moving to mobile payments:

- Security: Hoteliers and restaurant owners should take steps to ensure the security of customer data. This means implementing strong security measures, such as encryption and two-factor authentication, to protect against malicious activity. It’s also important to review your vendor contracts to make sure all data is secure.

- Cost: Mobile payment solutions can often be costly, so it’s important to shop around and find a solution that fits your budget. Also, factor in any transaction fees associated with using a mobile payment service, such as credit card processing fees.

- User Experience: Customers expect a seamless user experience when using a mobile payment service. Make sure that your chosen payment solution is easy to use and offers an intuitive user interface.

- Compatibility: Many mobile payment solutions require a compatible device, such as a smartphone or tablet, to work. If your hotel or restaurant is using devices that are not compatible, you may need to invest in new hardware before you can start accepting mobile payments.

- Integration: Your chosen mobile payment solution should be able to integrate with your existing systems, such as your point of sale (POS) system. This will help streamline operations and provide you with better insights into customer spending patterns.

By taking the time to consider these factors, hoteliers and restaurant owners can ensure that their move to mobile payments is smooth and successful.

How Much Does It Cost to Integrate Multi-Payment Feature in Mobile App?

Integrating a multi-payment feature in your mobile app isn’t as difficult as it may seem, but it does come with its own cost. Depending on the size of the business and the payment methods they accept, the cost can range from a few hundred dollars to thousands of dollars.

For smaller businesses, the cost of integration could include the development fee, software license, third-party platform fees, payment processor fees, and other associated costs. For larger businesses, the costs may include all of these plus any additional fees that may be required by the payment processor or third-party platform.

It’s important to understand all of the fees associated with multi-payment feature integration before committing to a mobile payment solution.

Some solutions may offer low upfront costs but require hefty ongoing charges, while others may be more expensive initially but offer lower overall costs in the long run. It’s important to weigh all of the options and consider your budget before making a decision.

Ultimately, integrating a multi-payment feature into your mobile app is an investment that could pay off significantly in terms of customer satisfaction and convenience.

Hotels and restaurants that don’t offer mobile payments will be at a disadvantage, as customers become accustomed to the convenience and ease of use of such features.

You can also check our other services:

Hire Mobile App Developers in India, Hire Xamarin App Developer in India, Hire iPhone App Developers in India, Hire Android App Developers in India, Hire Flutter App Developer in India, Hire React Native Developers in India, Hire Kotlin Developer in India, Hire Web Developer in India, Hire PHP Developer in India, Hire Laravel Developer in India, Hire Nodejs Developer in India, Hire Microsoft Developer, Hire ASP.NET Developer in India, Hire Angular.js Developer in India, Hire React.js Developer, Hire E-commerce Developer in India, Hire Magento Developer in India, Hire WordPress Developer, Hire MERN Stack Developers, Hire MEAN Stack Developers, Hire App Developers in India, Hire C# Developers, Hire CMS Developers, Hire Open Source Developers, Hire Vue.js Developers in India, Hire Knockout.js Developers, Hire AI Developers in India, Hire Java Developers in India, Hire Python Developers in India, Hire Javascript Developer in India